From sky-high inflation to the rise of AI, the restaurant industry has undergone an incredible amount of change in just a few short years. However, not all restaurants have experienced these changes in the same way. For multi-unit restaurants, the past year presented unique challenges and, in turn, some distinctive trends began to emerge at midsize restaurant concepts.

In order to better understand the distinct challenges facing multi-unit restaurants, the solutions that they’re employing, and where the industry is headed, we surveyed nearly 200 restaurant owners, CEOs, general managers, and area managers currently operating restaurants with five to 20 locations. This was part of a larger survey of 600 full service restaurant operators from across the U.S.

The result of our survey is hundreds of insights into the current state of the multi-unit landscape, how restaurateurs are adapting to a precarious economic situation, and the top trends on the horizon for 2024.

Below, you’ll find a sneak peek at the top chain restaurant trends for 2024. You can also dive deeper into the data by downloading the free industry report now.

The State of the Midsize Restaurant Industry

Overall, 2023 was a challenging year for multi-unit restaurants. From stagnant profits to soaring food costs and high staff turnover rates, multi-unit restaurant operators have been forced to adapt and look for new solutions that drive operational efficiency.

Here are just a few of the challenges they faced.

Sluggish Profit Margins

The past few years have been a financial rollercoaster for multi-unit restaurants and 2023 was no exception. Despite consumers resuming many of their pre-pandemic dining habits, the average profit at chain restaurants was 9.2%, which is just shy of the national average of 9.3%. Average debt was also higher at multi-unit restaurants, clocking in at $60,925.90 on average for midsize restaurants – a figure that’s 16% higher than the national average.

Staff Turnover Remains High

In addition to stagnant profits, multi-unit restaurants also had to contend with a revolving door of staff in 2023. As our report uncovered, 84% of multi-unit operators say they are currently short at least one position and, on average, most are short five positions. High turnover appears to be the culprit, with multi-unit restaurants reporting an average turnover rate of 34% – a figure that’s well above the national average turnover rate of 28%.

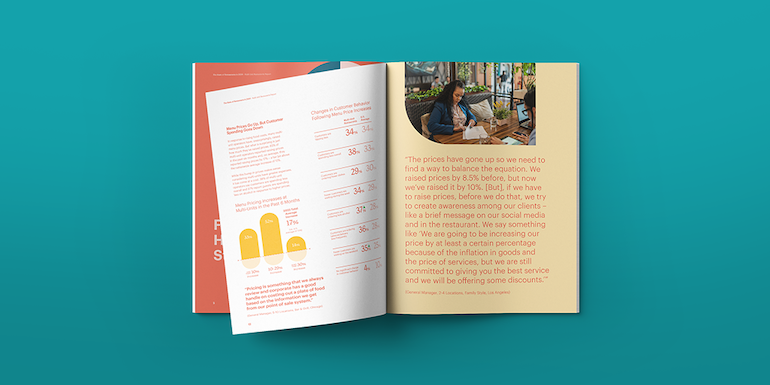

Rising Food Costs Cause Roadblocks

But perhaps the biggest challenge that the midsize restaurant sector faced in 2023 was soaring food costs. A whopping 71% of multi-unit restaurateurs reported that all or most of their suppliers had raised prices in the past year, which is significantly more than 60% of operators nationwide who said the same. The end result is that multi-unit operators are spending 47% more on food costs compared to the year prior – a figure that’s likely behind the flat average profits at chain restaurants.

Top Trends for Multi-Unit Restaurants in 2024

Despite the many challenges that midsize restaurant operators faced in 2023, a number of exciting new trends emerged. From AI to loyalty, here’s a sample of the top chain restaurant trends for 2024.

Going All in on AI and Automation

While restaurants have been slowly embracing automation for several years now, 2024 may be the tipping point for the implementation of AI and other forms of automation at chain restaurants. On the whole, 96% of multi-unit operators said they were currently using some form of AI in their restaurant, with the most common tech being digital assistants like Alexa and optical character recognition (OCR) technology, which is used to speed up manual processes like taking inventory and submitting invoices. And when it comes to automation, nearly 70% say they have already automated common tasks like payroll, invoicing, and accounting.

Chain Restaurants Make Big Bets on Personalization

While loyalty programs proved popular nationwide, reward programs seem to be especially prevalent at multi-unit restaurants. In fact, 77% of multi-units report offering a loyalty program, compared to the national average of 67%. However, it’s not just the prevalence of loyalty programs at chain restaurants that’s noteworthy, but the fact that many of them are using personalization to make these programs more attractive and engaging to diners. In fact, 66% of multi-unit operators report sending personalized offers to their customers, which suggests more bespoke loyalty experiences for customers in 2024.

To explore even more chain restaurant trends and midsize restaurant insights, download the full multi-unit restaurants industry report now.

This study was conducted by research firm Maru Matchbox on behalf of TouchBistro from June 15 to June 22, 2023. This particular report examines full service restaurants with five to 20 locations, which are referred to as “multi-units” throughout.

The statistically significant survey results are accurate 19 times out of 20. The detailed findings on this research by Maru Public Opinion are available at: Maru Public Opinion US.